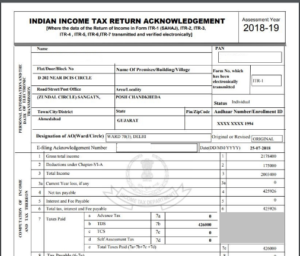

Then, in a short time, the particular download will start automatically.Click on ‘ITR-V/Acknowledgement’ to begin the download.

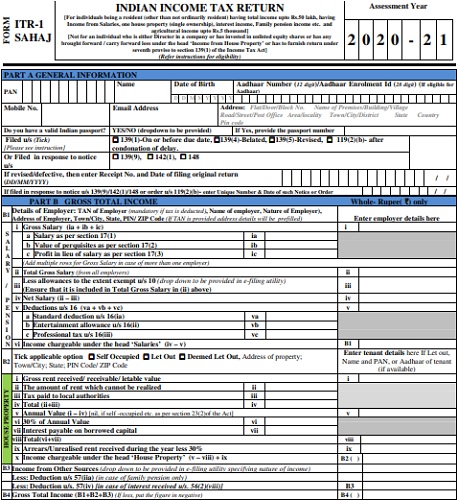

is encrypted and protected by password which is provided by the Income Tax Department as a proof of their e-filing. It is a type of confidential document i.e. There are five alternative methods for e-verification of ITR filing. ITR-V in other words ‘Income Tax Return- Verification’. Today, we will discuss how to open encrypted ITR-V documents along with electronic verification code generation methods. In our last article we have discussed how to submit and calculate income tax returns online with a simple and easy-to-understand guide. The password to open the statement will be your PAN Number (in CAPITAL) followed by your Date of Birth (DDMMYYYY) without any space or sign.Filing Income Tax on an e-filing website is pretty straight-forward. The statements may be downloaded in PDF or JPEG format. You may download both TIS and AIS as both contain the same information, but in summary form in TIS and in details in AIS. On selecting the AIS option, a new tab will open with two options – Tax Information Summary (TIS) on the left side of the page and AIS on the right side.Then go to Services Tab and select the AIS option from the dropdown.First log in to your income tax account in site.So, you will find it very easy to know and submit details for your ITR. So, after the introduction of AIS, Form 26AS will lose its relevance to an extent.Īnnual Information Statement vs Form 26AS: Now get more information at one place to file ITRįor now, it will not be stopped and a taxpayer can access both Form 26AS and AIS simultaneously. To overcome the problem and to make filing of return of income easier for the taxpayers, the Annual Information Statement (AIS) has been introduced, which aims to contain almost all the information needed to file an ITR. Nil tax even for income a tad above Rs 7 lakh

0 kommentar(er)

0 kommentar(er)